Banking While Black

The banking experience for African Americans has been tremulous. Most times, if you keep an ear to the street in these communities, financial literacy has tiers of inconsistency, mistrust, and poverty scars. The #BankBlack movement aims to fix the systemic issues that plague African Americans’ access to banking, but this sector is an untapped source of generational wealth if utilized correctly. A large portion of African Americans have limited exposure to financial literacy. The trend seems to ebb and flow every few years and then die back down into debt and frivolous cultural spending.

Each generation has different outcomes while climbing the economic ladder. The millennials, for example, have survived two recessions, a pandemic, have more student loans than any other generation, and the cost of living has skyrocketed to all-time highs. This is precisely the reason solutions to financial barriers are more important than ever.

Millennials will reach their peak earning power in the next decade and receive a vast wealth transfer from the baby boomer generation; there are gaps in wealth that need to be fixed. Millennials hold 4.8% of all wealth. Some of the oldest millennials are in their 40’s. Gen X had 9% of all wealth, and Baby boomers had 21% at the same age as millennials.

Barrier of Entry

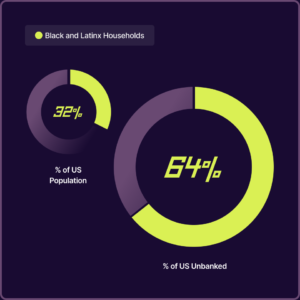

The barrier of entry into banks still has African Americans and Latinx populations on stand still. According to Boston Consulting Group “64% or around 7.1 million households of Black and Latino do not have a bank account.”

Boston Consulting Group (BCG)

Other large retail banks have the funding and location power to be everywhere and the ease of signing customers up for an account have modified their services for volume, online banking and scalability. In other words Black banks have stiff competition.

From my experience, the onboarding process to become a Black bank customer requires some resourcefulness, investigating, and patience. The state I live in only has three, and yes, you heard correctly. These banks are all centered in the inner city, which leaves many African Americans quickly being priced out by gentrification and rising rent to the suburbs or border towns. This causes bank deserts, and Black folk tend to go the least resistant path and bank with more ubiquitous branches in their area. We no longer use reformist reviews to gain wealth but more revolutionary ideas to create solutions instead of mere talk.

This is where education and communication play a prominent role. Culturally, the conversion around money is easier when you can make, store and pass it down for an extended period. African Americans, Latino Americans, and Native Americans just downright do not have enough time generationally with money and ultimately secure banking. Now, imagine how much of an impact early banking intervention would have on quelling poverty laser-focused on the unbanked through education and direct banking services.

BankBlackUSA has catered to education surrounding buying Black and endorsing serious banks about community rehabilitation and cross-generational wealth. When it comes to empowerment, BankBlackUSA has implemented several initiatives. An interactive BlackBank map, access to credit unions, rooting out banking deserts, the black commons project and COWRIE stands for Cooperative Wealth, Re-Investment, & Empowerment with a concentrated focus on access, advocacy, and acquisitions. Think of it as Wikipedia for Black banking.

Pegging Bitcoin with Black Banking

For Black capitalism to survive in the 21st century, investments are needed to keep dollars circulating within the community. I believe it starts with banks catered towards African Americans in conjunction with something undeniably reliable as a store of value such as Bitcoin. Late Rap icon Nipsey Hussle was heavily involved in the campaign to stop racial inequality in financial education and community activism. Soon many organizations, artists, and thought leaders followed. That was the first introduction to Bitcoin from someone revered in the hip-hop world for many in our community. What is more important is the level of education Nipsey pushed through his platforms to increase that awareness.

Bitcoin, for example, is a long-term investment that requires patience. Bitcoin is building itself up in layers just like the internet did two decades ago. Nipsey, even on a small scale, understood good things take time. The real question is how do African Americans take their wage to open a bank account that caters to people that look like them and hijack what playing the numbers did into something more secure like Bitcoin.

Imagine if the Black community could harness their savings in Bitcoin and utilize their online banking and checking accounts into banking entities like One United, Liberty Bank, or Industrial Bank. I believe that it would be great to close the wealth gap in underserved communities.

Bitcoin is censorship-resistant. It can’t be censored. There will only be 21 million Bitcoin in circulation.

There are 50 million millionaires in the world. If you do the math, that’s a win-win. Diverse communities have a long history of eminent domain and lack of cross-generational wealth, so pegging Bitcoin to the Bank Black movement may be an idea with excellent upward mobility if it catches on.