How much does it cost to be you?: An Interview with Lola C. West on making your own plans

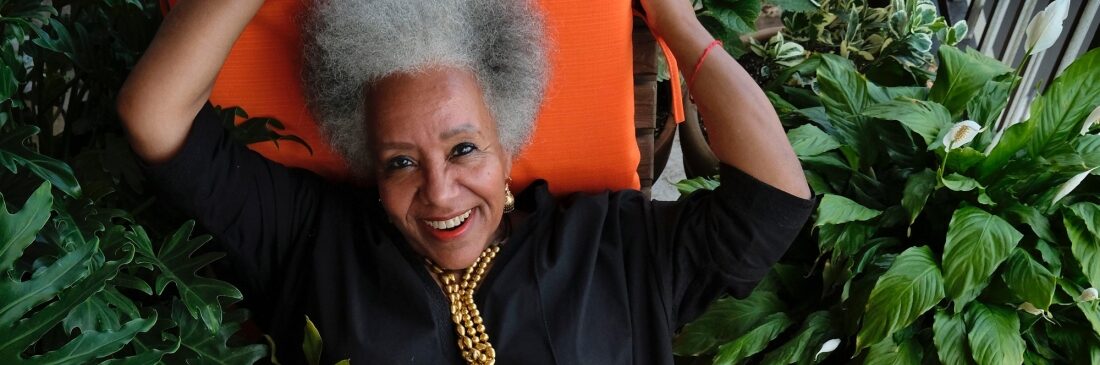

Lola C. West currently operates as a co-founder and partner of Westfuller Advisors, a wealth management and investment advisory firm based in New York City. Westfuller is one of the largest black owned advisory groups in the United States. West sat down with BankBlackUSA to discuss how she put herself on this path. With the Black History Month passed and Women’s History Month wrapping up, West offers a testament to the strength and limitlessness of Black Women. While settled in her position today, West has moved through life with will and focus, navigating from one opportunity to the next.

She began her adult years at Brooklyn College in 1965. The college, a predominately white institution, constantly reminded her that all eyes were on her, waiting for her to fail and give up. They would learn, as you will in this article, Lola C. West does not fail and never will. Like many others in college, West changed majors a few times, going in as Pre-Med and graduating with a Bachelors Degree in Psychology. She anecdotally offered up the sentiment that if something does not work for you, find something else that does. After college, she had the choice to attend law school and pay out of pocket or take a sixteen thousand dollar ($16,000) scholarship for a Masters Degree in Urban Planning, unchanged for inflation. West knew that debt would only further the racial wealth gap that set her 400 years back from her white peers and took the scholarship. Admittedly, she never used the Masters Degree in Urban Planning; regardless, the degree helped her advance.

The next step for West was surprising, but as you come to know Lola C. West maybe not. She opened an antique store. She rehabilitated and sold antique pieces for a few years. She knew her days as a shopkeeper were coming to a close when she refused the sale of a refurbished table. Lola expounded: “ It was gorgeous…the center of the table had inlaid, hand painted leaves, and someone had painted the table black. So I stripped it, I painstakingly stripped it, and I put a price tag on it. It’s like $250. And this woman came into the store. And she said…I’ll give you $75 For the table. And I looked at her and I said, ‘you know, you don’t have to buy it.’” Quickly after West dismissed the disparaging customer, she remembered that no store would survive without sales. She needed a new path forward. West closed down the shop and found another job.

West became the Executive Director of the HeadStart Program. She enjoyed the program’s aim and teachers, but opposed its leadership. During Black History Month, the HeadStart teachers taught their preschoolers about historical figures like Martin Luther King, Jr. and Malcolm X. One day the board chair said to West, “I don’t want those children learning nothing about no Malcolm X because he was nothing but an international rapist. I said, Okay, time to go. So, that job lasted a year.”

West remained in tune with herself, knowing when her limits had been pushed and when the time came to pivot.

She shifted careers. West was a hospital administrator. For 11 years, West helped rehouse disabled people. She started out managing one (1) facility and within eighteen (18) months handled seven (7) properties. Despite this, the association promoted West’s apprentice over her. She remarked, “they promoted a white woman over me that I had trained, so I quit. You know? And they said…, you can’t quit. I said, Are you crazy?… Do you think I’m a report to [her]? So, I left…Because you have to look out for you, no one’s gonna do that for you. And no one was going to make me stay someplace that didn’t respect me.”

After West left with her dignity and self-confidence intact, she read What Color is Your Parachute? by Robert Bowles, a book for those trying to figure out what they’re going to do. She found out what she loves to do: “throw parties and raise money.” So, that’s what she did. West created an events company. She planned events for the President and the Board of Education and Mayor Koch; designed Nelson Mandela’s strategic fundraising plan when he was running for president; and organized Jessye Norman Sings for the Healing of AIDS in 1996, which won an Emmy for Societal Programming.

As computers rose in popularity, conglomerates used them to restructure their charitable giving efforts. Instead of giving as individual companies, large corporations created foundations. Unfortunately for West, “instead of being able to get five checks, [she] was only going to be able to get one. So [she] said, Oh, no, and the thing was they gave $250,000 to the [majority] organizations, but to the [minority] organizations they gave $25,000… So, [she] dissolved [her] corporation in 1997.”

West took three (3) years off, during which she watched CNBC everyday and played the stock market. When speaking to a friend who worked as a headhunter, West realized she had an affinity for the financial markets. West thought to herself, what if I made this a career? She called up a friend who worked at Merrill Lynch and got herself an interview. West landed a job as a financial advisor. When the banks lost their integrity in 2008, as the stock market crashed, financial institutions pushed their employees to trade in their morals for checks; disregarding client wishes. West was not on board, so she disregarded their so-called advice and made an exit plan. After a year, she left Merrill with Ian Fuller to create their own company.

Now, West helps run their very successful independent firm.

Throughout her career West understood that she was in charge of her decisions. Whenever she left a job, West went out and found her next opportunity. She said, “I move from one thing to the next because I’m responsible for me. I’m not quitting, because I got somebody to take care of me. I quit, and I know it’s on me. So, then I act accordingly. There’s a method to my madness. I have never failed!”

To fail is to give up. To fail is to limit your potential. The key to success is to understand that you’re limitless and know what is serving you.

While we most can agree West hasn’t and won’t fail, curiosity arose: how can the West afford every career shift and unexpected turn in the path of life? West followed up that question with another: how much does it cost to be you?

West knew from an early age that “Lola was taking care of Lola”: you take care of you. Knowing that, you have to budget. You have to save. You have to make a 401k. You have to avoid debt. You have to be responsible for yourself.

Sit down without you, and ask who do I want to be. What is the cost of being me? Then, make a plan. No matter what, take care of your future.